Home insurance

Our home is our castle – it is a place where we feel safe and share moments with our loved ones. With home insurance, you do not have to worry about unforeseen events that may happen at home – the insurance covers unexpected damages.

Call for Home Assistance: +372 655 5401

House, cottage or apartment insurance

Why is it necessary?

If something unexpected happens – a natural disaster, fire or other unexpected event – it is very difficult to bear such losses without insurance. The role of insurance is to help you cope better with financial losses in such unforeseen situations, so that you can return to normal life in the shortest possible time.

Property insurance

Insure your apartment, row house, house, outbuilding or cottage. At ERGO, you can choose the right package and coverages for you.

Household property insurance

In addition to insuring buildings, we also cover the furnishings that make your house feel like home: furniture, electronics and other personal items.

Third party liability insurance

Personal liability insurance protects you in case you cause damage to others or their property. For example, if a water leak from your apartment ruins the apartment of a neighbour downstairs.

Pet insurance

Give your furry friend the best care in the event of a sudden illness or accident, without worrying about unexpected expenses.

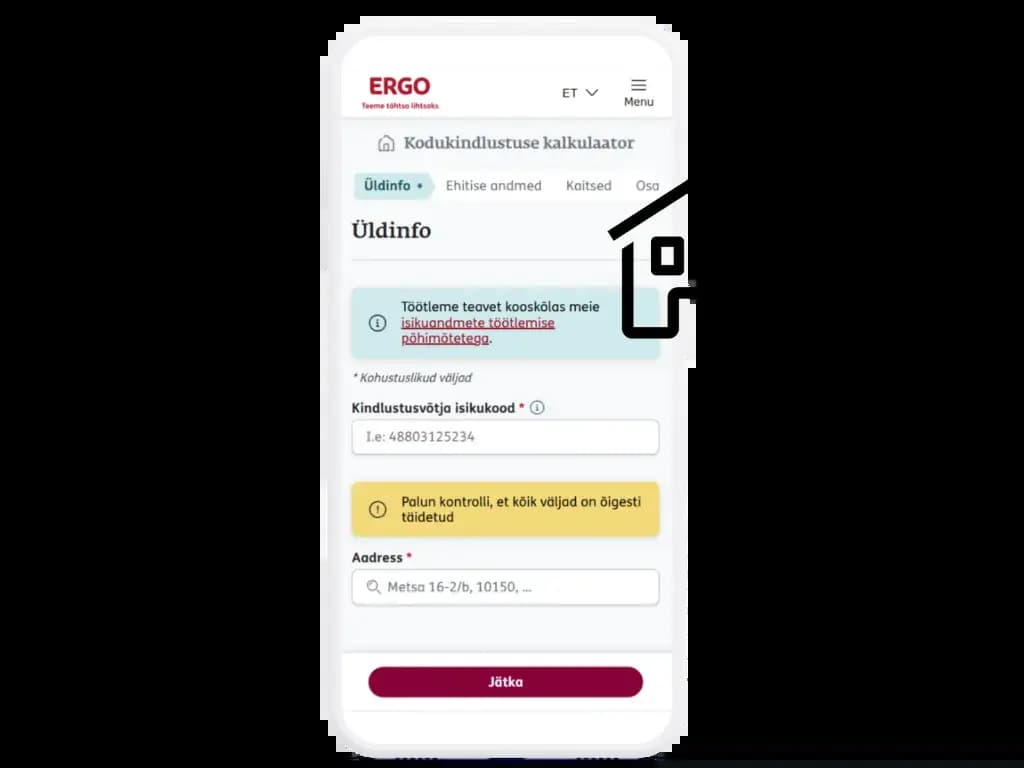

Home insurance calculator

Upgraded home insurance with additional coverages provides extra extra reassurance and the opportunity to tailor protection to your needs. In addition to your home, it is now also possible to insure pets.

Calculate the price of home insurance and choose the coverages that give you peace of mind in unexpected situations.

(New) home insurance with additional coverages

A home is more than just a property – it is a life filled with experiences and memories worth protecting. Home insurance helps cover the financial loss that may arise from unforeseen events. With modular home insurance, the core cover protects against the main risks, and you can add a range of additional coverages to suit your individual needs.

Fire

We provide compensation in the following cases:

- fire;

- explosion;

- direct strike of lightning;

- impact from an aircraft, or parts of an aircraft, or its cargo.

Water damage

We compensate for damage directly caused by:

- the escape of liquid from the building’s technical systems (water supply, heating, sewage or stormwater piping);

- water leaking as a result of the failure of household appliances permanently connected to the building’s internal water system (such as a washing machine, dishwasher or water heater) and their connecting components.

Storm

We compensate for damage caused by a storm (wind speed of at least 18 m/s) or hail.

Flood

We compensate for damage directly caused by natural flooding, including flooding resulting from storm, heavy precipitation or the overflow of a body of water.

Vandalism

We compensate for damage incurred as a result of:

- unlawful actions by a third party causing damage to, destruction of, or theft of the insured property;

- a collision involving a land vehicle;

- theft resulting from a break-in to a building or its premises;

- robbery.

All risk e.g. other cases that are not excluded by Terms and Conditions

We compensate for damage directly caused by any other sudden and unforeseen event not defined above and not excluded under the terms and conditions.

(New) home insurance with additional coverages

A home is more than just a property – it is a life filled with experiences and memories worth protecting. Home insurance helps cover the financial loss that may arise from unforeseen events. With modular home insurance, the core cover protects against the main risks, and you can add a range of additional coverages to suit your individual needs.

What additional coverages can be added?

Depending on how the insured apartment or building is used and on your individual needs, you can add optional coverages to the core protection.

Rent expenses for temporary residence

If the permanent residence becomes uninhabitable as a result of an insured event, we compensate reasonable and justified expenses incurred in finding and renting comparable temporary accommodation, as well as the costs of moving there and back.

ERGO home assistance

We compensate the cost of home assistance in the event of a sudden incident involving the insured building that requires immediate action. For example:

- opening a door in the event of key theft, loss, malfunction of the locking system, etc., and, if necessary, repairing or replacing the lock cylinder;

- initial containment of a pipe leak and replacement or repair of the component that caused the damage;

- drying of the damaged building, if necessary due to a pipe leak or flooding;

- temporary repair or covering of damaged or broken openings (windows, doors, roof);

- assistance in finding and moving to temporary accommodation.

The service applies only if it is ordered via the ERGO home assistance phone number indicated on the policy.

Household property outside the insured premises

Personal belongings carried by you or your family members are insured within Europe up to a limit of EUR 2,000.

Rainwater ingress

Initial ingress of rainwater into the building. We compensate for damage caused to interior finishes or household contents up to 5,000 euros, provided that no water has entered the insured building within the last five years.

Internal failure of technical systems

We compensate for damage to technical systems up to 7 years old (e.g. a heat pump, boiler, water heater, solar panels, ground source heating system) and to the building’s electronic components (e.g. gate automation, alarm systems) caused by:

- an interruption, disturbance, or voltage fluctuation in the electricity supply;

- an internal electrical or mechanical failure or malfunction of the insured item itself.

Internal failures of household appliances

We compensate for damage to household appliances up to 4 years old (e.g. refrigerator, washing machine, cooker, robotic lawn mower, television) and to laptop and desktop computers up to 3 years old, caused by:

- an interruption, disturbance, or voltage fluctuation in the electricity supply;

- an internal electrical or mechanical failure or malfunction of the insured item itself.

Breakage of smart device

We compensate for damage resulting from the breakage or damage of a smartphone, smartwatch, tablet, and their accessories that are up to two years old.

Loss of rental income

If you have rented out your apartment or house and, due to an insured event, the tenant is unable to live there, we will compensate you for the loss of rental income for the period during which the rental property is uninhabitable, up to a maximum of 6 months.

Tenant-caused damage

We compensate for damage to interior finishes or household contents intentionally caused by the tenant or resulting from the tenant’s gross negligence.

Loan or lease payment insurance

We compensate housing loan payments for up to a maximum of five months if the residential building or apartment is destroyed by more than 50%.

Legal advice

Get free advice on legal matters related to your insured home.

What additional coverages can be added?

Depending on how the insured apartment or building is used and on your individual needs, you can add optional coverages to the core protection.

Why choose ERGO for your home insurance?

ERGO 24/7 Home Assistance

Cover against moving and rental costs of temporary housing

Legal advice on home-related matters

We will compensate for damage to interior finishing and/or household property caused by a rainwater leak, up to EUR 5,000, provided that the building has not been flooded in the last five (5) years.

What is the home insurance deductible?

The home insurance deductible is the amount you have to pay yourself in the event of damage. For example, if there is water damage at home resulting in repair costs of EUR 1,000 and the deductible chosen in the contract is EUR 300, we will compensate EUR 700 of repair costs

Did you know that if you have at least three different types of property insurance contracts at ERGO (traffic insurance, motor hull insurance, home insurance, accident insurance, multi-trip travel insurance and legal assistance insurance), your deductible is EUR 100 lower in case of a home insurance loss event.

Tenant insurance

As a tenant, you can insure your personal belongings, such as sports equipment, computer, phone, with household property insurance. Liability insurance covers you in situations where you unintentionally cause damage to third parties. For example, if water filling the bathtub is accidentally left running and damages the apartments located below.